When Maddi Lacari thinks of her life now, inflation touches every aspect.

“During my lunch break at work, instead of getting a sub from Subway, I will get a bagel from Tim Hortons as it is only $2. It is definitely not as filling as a sub and causes me to be hungrier, but it is cheap and that is what I need,” Lacari said.

The Consumer Price Index (CPI), which measures prices for products and services Canadians buy, rose 6.9 per cent in September, according to Statistics Canada. Although some prices for things some students buy, like gas, fell somewhat, prices for food, rose even quicker, at 11.4 per cent in September.

As a result, some students are feeling even more pressure from inflation than they are from their schooling.

While students have adapted to the pressures of schooling, meeting each deadline and mastering the right school–to–life balance, Lacari, a child and youth care student at Algonquin College, said she has lost the freedom to spend money freely. She is even skipping meals.

“I now constantly think that I do not need to eat because it costs too much money,” Lacari adds.

Inflation does not just affect food. It hits other student necessities like transportation and housing, forcing students to make tough decisions.

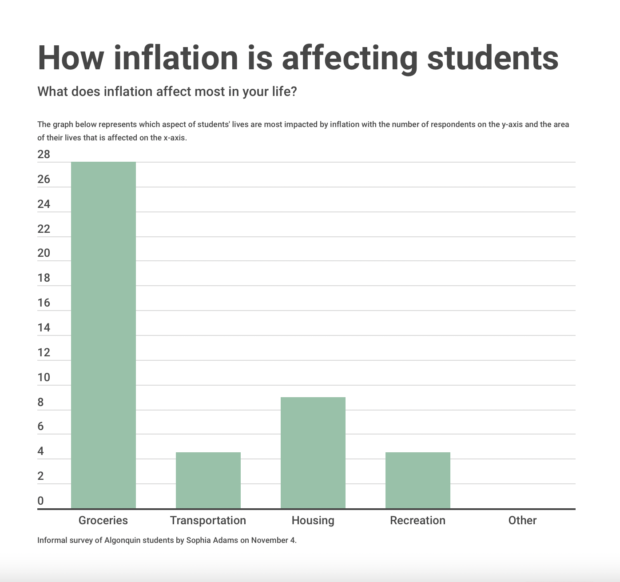

To better understand the effects of inflation among the students at Algonquin College, the Algonquin Times surveyed 45 students in the E-building in the early afternoon of Nov. 4.

Seventy-five per cent of the students the Times talked to said they now resort to borrowing money from family members and the same proportion said keeping within their budget has become harder.

Unable to pay her car expenses or buy clothes without worrying, Lacari worries about what resources she will have to rely on in the future if prices continue to rise.

Students living at home with their parents told the Times that while they do notice inflation, they are sheltered from its greatest impact.

According to Friday’s survey, 25 per cent of students are working full-time while they are in school and 20 per cent work just under that but are still finding prices far more demanding than they can manage.

Fifteen per cent said they are using deferred payment plans for their tuition to kick expenses down the road. Five per cent said they had resorted to using a food bank just to get by.

Saddened with the Canadian government’s response to inflation — or the lack of response — Lacari wishes that the government offered more help to those in need.

Evelyn Glube, a student success specialist at Algonquin College, said she sees the impact inflation is having on students through her work each week at the college.

Keeping in tune with the emotions and talk among the students, Glube has noticed an increase in the number using the word “overwhelmed” when describing how they are feeling.

For students like Hallom Hamid, who already has every paycheque stretched to the last dime, inflation could not have a more negative impact.

“It felt like I blinked and prices were up. I had no time to adjust and feel like I am playing catch up to the prices all the time,” Hamid said.

Working 35 hours a week, Hamid, a full-time early childhood education student, works as many hours at her job as she is in school.

Hamid lives at home, in a family of six that is feeling the inflation of food prices badly and reserves $200 from each of her paycheques to contribute to her household’s grocery bill.

Hamid explained she is happy to contribute to her family, but she worries about the quality of food she is getting rather than the quantity.

“I started consuming more fast food and less fruit, which caused my eating patterns to change for the worse,” Hamid said.

Hamid started using reward-points systems to stretch the value of her budget. Gaining points for the money she spends, Hamid is hopeful the accumulation will assist in the purchase of more nutritious foods.

Algonquin College is prepared to help students through internal bursaries and external scholarship opportunities and Glube said students are encouraged to apply to ease their financial situations. Glube said despite her office’s best efforts, she still encounters students who are unaware of the options available to them.

For those who are facing difficulties and who would benefit from support, Glube advises students to communicate with employers and instructors about the hardships they are facing.

“Your instructors have expectations and standards that they need to uphold, but they’re also human — they hear your concerns and will do what they can do to accommodate and support you,” Glube said.