This January, cryptocurrency experienced a lull in its ever-fluctuating value, the lowest it’s been since reaching upwards of $20,000CAD mid-December according to Coinbase.com and investors are panicking.

In January alone, Bitcoin, with most other cryptocurrencies following, has dropped significantly. There is no one explanation for this, but can speculatively be linked to natural correction.

According to a series of graphs posted to Twitter by user @ArminvanBitcoin, a veteran cryptocurrency investor, the phenomenon happens every year, dating back to 2015. Prices fall at the end of December and recover in following months.

Investors at Algonquin have taken notice.

“January hurts, it hurts bad,” said Nathan Smith, 21, a police foundations student at Algonquin.

Smith started researching the cryptocurrency market in September and two months later when Bitcoin, Ethereum, and Litecoin picked up a lot of speed, he deemed it an appropriate time to finally buy in.

“I keep missing the jumps because I’m not going in, so why not just go in?”

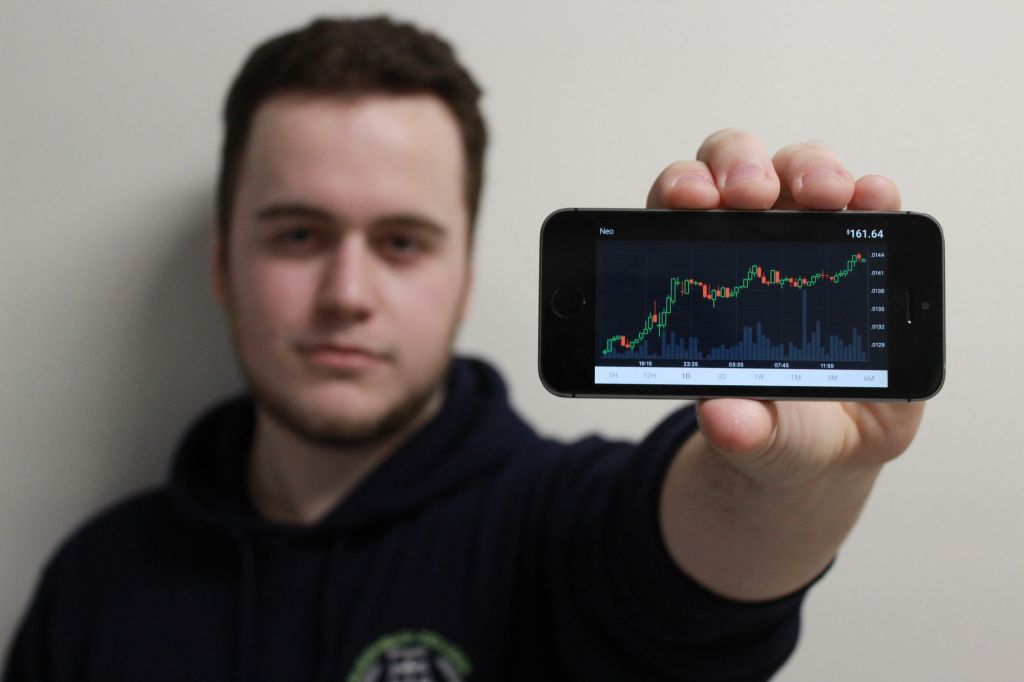

He now boasts a wide portfolio. He holds major coins, Bitcoin and Etherum among quickly tradable alt-coins such as Ven and TRX.

“Having a big portfolio is key,” he says. “It’s not just about what I’m holding on to, it’s about what’s coming into the market, what’s crashing and what’s going to the moon.”

A coin “going to the moon” means that its profit is going to increase drastically. This is why Smith deals in smaller, less valuable alt-coins. Cents to dollars trading is where Smith thrives.

Having an initial investment of $250CAD, Smith’s profits are around $2,000CAD to date.

“My profits are down right now because it’s January,” but Smith is excited about a potential upturn in February. Until the adoption of cryptocurrency to the modern world, there is plenty of room to make money according to Smith.

“Right now, it’s the wild west.”

Smith plans on keeping cryptocurrency as a secondary source of income for as long as he can.

“I love the high too much now, I love the game, I love the rat race, I enjoy it too much,” he said. “A secondary stream of money never hurts.”

Eventually Smith transferred his skills gained from crypto trading to other media like the traditional stock market.

Although the panic-inducing cryptocurrency market is an emotional roller coaster, the easily accessible market has taught him priceless financial management skills he can use in life after graduation and into his retirement.

“You have to ride that roller coaster and keep your emotions in check,” he said. “We’re millennials, we have to be looking into TFSA’s and RRSP’s, we have to be smart with our money, and that’s what I’m trying to do.”

Smith is hopeful his numbers will improve, but until then, he will hold on to dear life for the remainder of this low time.